Save the Tip Credit

Keeping the Tip Credit means keeping high-earning server jobs!

Under the current tipping system, the average server earns $27/hour. Many servers and bartenders report earning as much as $50/hour over the course of the work week. Tipped employees have made it abundantly clear that the current tipping system is not broken and does not need to be changed.

However, a national activist group continues to lobby Maryland lawmakers to eliminate the tip credit. In 2023 alone, this activist group attempted to pass legislation to eliminate the tip credit at the statewide level, in Prince George’s County, and in Montgomery County. They failed all three times because servers, bartenders, restaurants, and the Restaurant Association of Maryland all voiced strong opposition to these bills.

Eliminating the tip credit will lead to increased menu prices and service charges being added to customer checks. Research shows that customers will not tip on top of service charges, especially when employees are being paid a minimum wage hourly rate by the employer. Customers do not freely tip at quick service or fast casual restaurants today, so we know this to be true.

As a result - servers will make less money because they won’t be getting significant tips, customers will pay higher prices, and restaurants won’t be able to retain servers because they won’t work for a flat hourly rate without tips. EVERYONE LOSES.

Learn about the Tip Credit with 7 simple questions:

What is the Tip Credit? The tip credit means restaurants can pay servers, bartenders, and other tipped employees in Maryland $3.63* an hour plus tips.

Does that mean that tipped employees in Maryland only make $3.63* an hour? Absolutely not. By law, tips are considered part of an employee’s wages. Therefore, you must include tips when you calculate an employee’s hourly rate of pay. The average server in Maryland earns $27/hour with their tips.

What happens if customers don’t tip or if tips are low? By law, tipped employees must be paid at least minimum wage for the work week. If an employee does not get enough in tips to earn minimum wage, then the restaurant must make up the difference.

How does a Server know for certain that they made at least minimum wage with their tips? In 2019, the state of Maryland passed a minimum wage law that included a provision that requires restaurants to provide tipped employees a “Tip Credit Wage Statement”. This tip credit wage statement shows the actual hourly rate of pay when adding together $3.63*/hour plus tips for the workweek. This tip credit wage statement verifies that the employee was paid at least minimum wage and shows their exact hourly pay rate.

Won’t Servers make more money being paid minimum wage plus tips? Servers and bartenders answer this question with a resounding – NO. Here’s why: Restaurants would need to significantly increase menu prices and add service charges to every check in order to pay servers minimum wage, instead of using the tip credit wage. As a result, customers will not tip on top of service charges because they know that employees are already making minimum wage. This is proven true every day, as people generally do not tip freely in quick service and fast-casual restaurants.

With tips that average nearly 20% of a check, servers earn on average $27/hour and many report earning up to $50/hour. Servers want the opportunity to earn significantly more than minimum wage and do not want the current tipping system to change – we should listen to them.

Aren’t service charges the same as a tip? Don’t they go to the server? NO. Federal law states that any service charge or fee that is automatically added to a check is considered income for the restaurant and is not a tip for the employee. Therefore, the server has no right to a service charge and the restaurant has no obligation to give it to the server either. Again, this is Federal law and not a restaurant policy.

Why should customers have to tip and be “required to pay the wages of employees”? Shouldn’t the restaurant be responsible for that? Every business, no matter what service they provide or product they produce, relies on customers to pay their employees. When we purchase goods at a store, those sales are used to pay employees. When a repair service is performed in our homes, the bill we pay is used to compensate employees. Although it may look different in a restaurant, it is still the same. Whether a tip or a product sale, we all contribute to paying employees.

*In Montgomery County, Maryland, the tip credit wage paid by the employer is $4.00 per hour.

Failed Attempts to Eliminate the Tip Credit in Maryland

After so many failed attempts, why does a National activist organization continue to push this agenda and mislead lawmakers?

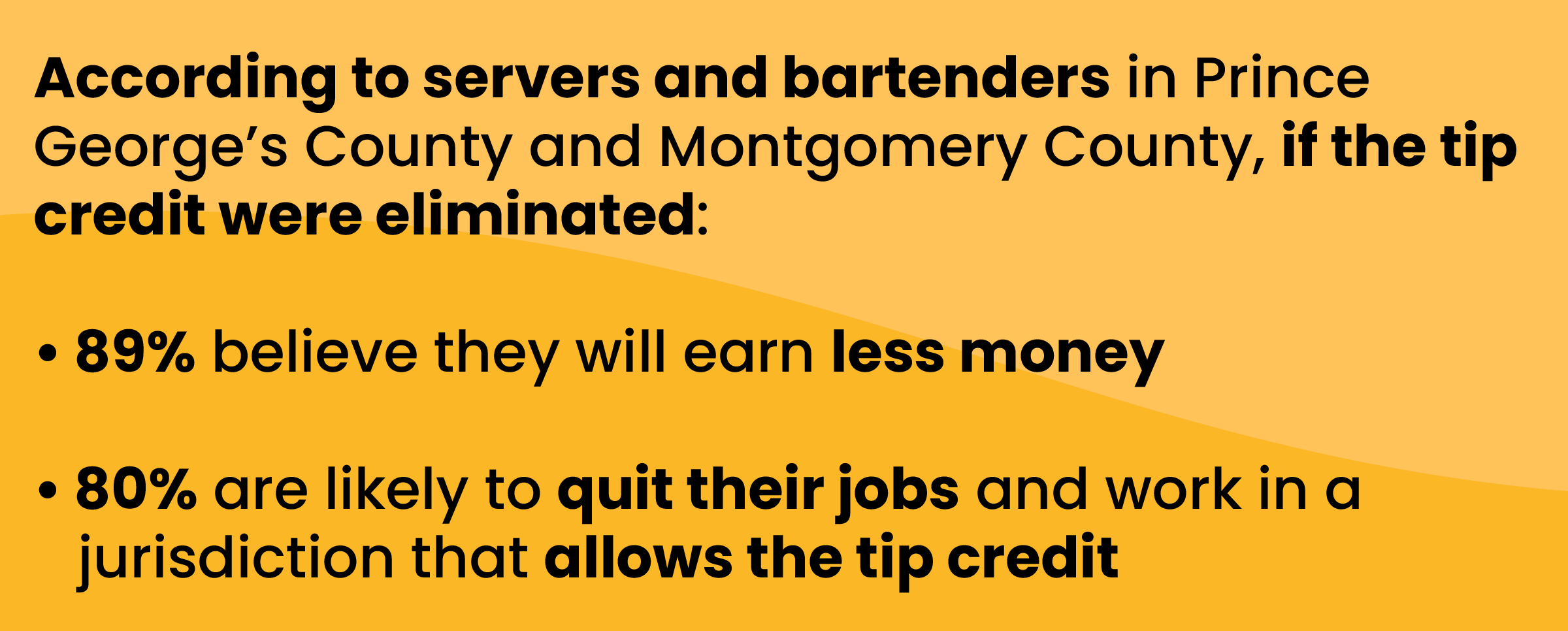

Servers, bartenders and tipped employees continue to fight against the elimination of the tip credit. Tipped employees have made it abundantly clear that they earn significantly more than minimum wage under the current tipping system and without the tip credit in place, their earnings will decrease. Tipped employees do not want, and did not ask for, this type of legislation.

Lawmakers in Maryland have consistently listened to the actual tipped employees who live and work in their jurisdictions and have rejected all attempts to eliminate the tip credit.

It’s time for outside activist groups and rogue lawmakers to stop pushing this agenda and leave tipped employees alone! Keeping the Tip Credit means keeping high-earning restaurant jobs!

Maryland General Assembly Session 2024 – a bill was introduced that would eliminate the tip credit. Hundreds of servers and restaurant operators urged lawmakers to reject this legislation. Over 100 tipped employees attended and testified at the State Senate hearing in unified opposition. Because of strong industry objections, lawmakers allowed this bill to die in committee without a vote. Shortly after the Senate Committee hearing, the sponsor in the House of Delegates withdrew the bill before it could receive a House committee hearing.

October 17, 2023 – During a Montgomery County public hearing, over 100 restaurant servers, bartenders and restaurant owners showed up to support their peers who were testifying against eliminating the tip credit. The activist group pushing for this legislation did not have one person testify who actually lived or worked in Montgomery County. The council appeared very concerned that out-of-state people were supporting a bill that residents of Montgomery County did not want. There is clear momentum for the committees working on this bill to reject it altogether in January 2024.

October 12, 2023 – A committee in Prince George’s County held a hearing to discuss eliminating the tip credit. After overwhelming opposition from servers, bartenders and business owners who lived and worked in Prince George’s County, the bill was “tabled indefinitely” by the committee. This means that the bill to eliminate the tip credit was rejected and will not be brought to the full council for a vote. Another win for tipped employees!

Maryland General Assembly Session 2023 – a bill was introduced that would eliminate the tip credit. Hundreds of servers and restaurant operators urged lawmakers to reject this legislation. A busload of tipped employees attended and testified at the State Senate hearing in unified opposition. Because of strong industry objections, lawmakers allowed this bill to die in committee without a vote.

December 2021 – a bill was introduced in Howard County that would increase the county minimum wage and also eliminate the tip credit. After hearing directly from servers and business owners, the bill was amended to keep the tip credit in place. The increase in the minimum wage did pass.

Maryland General Assembly Session 2019 – a bill passed to increase the minimum wage to $15/hour by 2025. However, there was also a provision in this bill that would have eliminated the tip credit. Hundreds of servers and restaurant operators urged lawmakers to reject this piece of the legislation. The bill that passed was amended to leave the tip credit in place. A big win for tipped employees who contacted lawmakers in force to have their voices heard!